estate tax malaysia

You might be shocked to find out the different taxes imposed on you when you purchase or even own a property. The income is classified into 8 different tax groups ranging from 0 to 26.

Invest In Dual Key Condo Near To Nottingham University In Malaysia With 1000 Rm Booking Fee For More Details Please Contact Condo Property Ad Best Investments

Prior to 1984 estate duties of 12-45 were levied on property with a minimum value of RM100k for deaths in Malaysia 5-60 on property with minimum value of RM40k for deaths outside Malaysia.

. Real Property Gains Tax RPGT Rates Disposal Date And Acquisition Date Disposal Price And Acquisition Price Determination Of Chargeable Gain Allowable Loss EXEMPTION Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Name of deceased persons estate as registered with LHDNM. It was levied on transfer of property from deceased person to beneficiary.

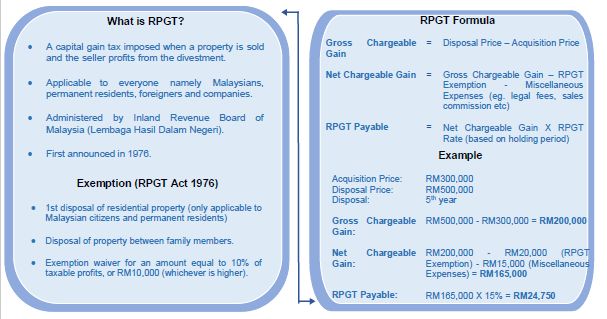

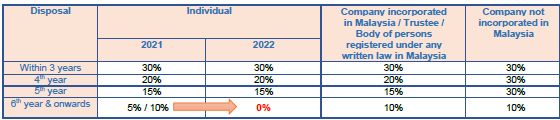

Stamp tax real property gains tax exemptions for certain residential property transfers COVID-19 Malaysia. Taxes incurred with owning and managing real estate. However real property gains tax RPGT applies to properties sold less than five years after purchase.

Income Tax for Rental. Duty to notify and posthumous assessments. We will cover as much as we can within this article.

Whether youre a property investor or an owner just simply looking to sell your current home to purchase your dream home its important to be aware of all costs associated with a real estate transaction. A property rented out at RM2000 for 12 months has an annual rental income of RM24000. Those sold less than two years after purchase are subject to ten percent RPGT and those sold between two and five years after purchase are subject to five percent RGPT.

Prior to the abolition of this tax in 1991 estate duty was applicable only if the net worth of the estate exceeded RM2 million. The income tax of non-residents is calculated on a three-step tax rate 27 15 and 10 depending on the type of income. Property Taxes in Malaysia can be quite a challenge to a first time buyer or investor.

For context Malaysia used to have inheritance taxestate duty. Please refer RPGT for more. This means that in Malaysia there is no final tax on the accumulated wealth of a deceased individual.

For individual foreigners if the disposal of the real estate is within 5 years after the date of acquisition the rate of tax is 30. The rate of tax is 10 if the disposal is in the 6th year after the date of acquisition of the real estate or thereafter. Therefore it means that when you decide to sell your property you have to pay taxes on the profit if you have any.

Real Property Gains Tax There is no capital gains tax in Malaysia. Stamp tax real property gains tax exemptions Exemption orders were released to implement proposals announced under an economic recovery plan in response to the coronavirus COVID-19 pandemic. Currently Malaysia does not have any form of death tax estate duty or inheritance tax.

Sales tax and service tax The rate of both sales tax and service tax is 6. The following are the property taxes that you should know before a major property decision. Inheritance tax in Malaysia was known as estate duty back then.

In simple words it means you no longer pay any form of final taxes on the accumulated wealth of your assets and accounts after you have died. Net wealthworth taxes There are no net wealthworth taxes in Malaysia. Real Property Gains Tax RGPT is a form of Capital Gains Tax that owners have to pay when disposing of their property in Malaysia.

There was an estate duty in place until 1 November 1991 when it was abolished. Enter X in one relevant box only. Inheritance estate and gift taxes There are no inheritance estate or gift taxes in Malaysia.

Income tax number of deceased persons estate as registered with LHDNM. If the gross value of the estate is for only movable property and is less than RM600000 and no person is entitled to apply for Grant of Probate or Letters of Administration one may apply for summary administration via Amanah Raya Berhad section 17 Public Trust Corporation Act 1995. However there are certain circumstances where the deceased will still have to pay taxes on their assets.

STATUS OF TAX To facilitate the processing of the return forms it is advised to complete this Section correctly based on the tax computed on page 7 of Form TP 2015. In Malaysia Real Property Gains Tax RPGT is one of the most important property-related taxes and is chargeable on the profit gained from selling a property. The income tax rate for residents is calculated on the amount of income and is much more precise.

That law was abolished in November 1991. Real Property Gains Tax RPGT Rates Disposal Date And Acquisition Date Disposal Price And Acquisition Price Determination Of Chargeable Gain Allowable Loss EXEMPTION Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. If property repairs cost RM5000 quit rent is RM50 and assessment tax is RM500 then net rental income is.

Malaysia My Second Home Program Retire In Malaysia Part 7 Retirepedia Malaysia Retirement Relocation

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Estate Planner Has To Spend A Considerable Amount Of Time In This Field Estate Planning Estates Malaysia

Climate Weather In Malaysia Retire In Malaysia Part 1 Retirepedia Malaysia Resorts Malaysia Peninsular Malaysia

Can Lhdn Force Your Family Members To Pay Your Tax If Asklegal My

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Hoping You Ll Love This Post Proton Ertiga Executive Manual Http Nazzjanggut Blogspot Com 2017 08 Blog Post Html Utm Campaign C Protons Electric Power Ebd

Estate Planning Estate Planning Home Buying Real Estate

Where Not To Die In 2022 The Greediest Death Tax States

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Winbox Lottery Payment Lottery Betting Lucky

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Comments

Post a Comment